- All of the days you were present in the current tax year

- 1/3 of the days you were present in the prior tax year

- 1/6 of the days you were present in the year before the prior tax year

For example, in 2022, this test would look like:

- 31 days during 2022; and

- 183 days during the 3-year period that includes 2022, 2021, and 2020, counting:

a. All the days you were present in 2022,

b. 1/3 of the days you were present in 2021, and

c. 1/6 of the days you were present in 2020.

However, a foreign individual can meet the substantial presence test and still:

- Not have permission to work from the U.S. Customs and Immigrations Service (USCIS)

- Be ineligible for a Social Security number (SSN)

- Be required to file a U.S. federal income tax return

These individuals must check this box, then include a date of entry in Line 6d, below.

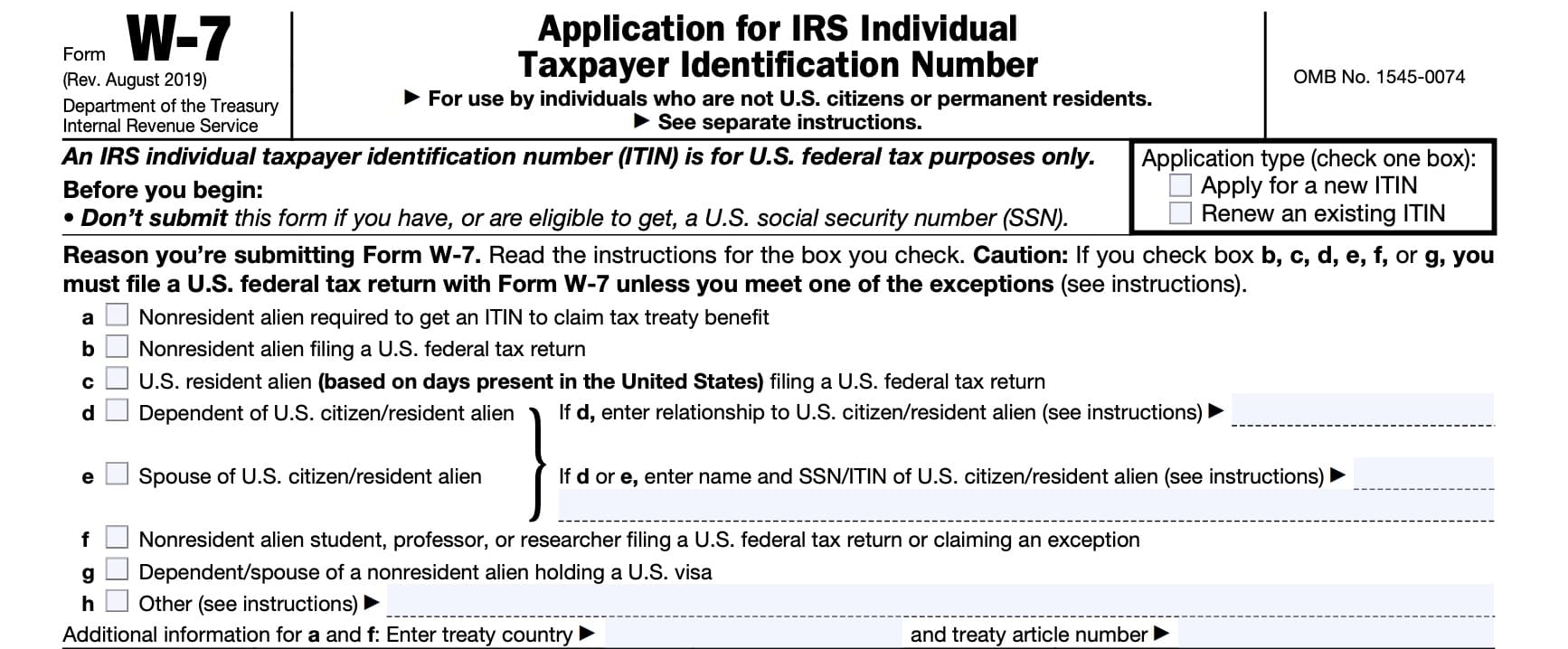

Box (d): Dependent of U.S. citizen/resident alien

Family members can check this box if:

- You can be claimed as a dependent on a U.S. income tax return, and

- You are not eligible to obtain an SSN

However, spouses are never considered to be dependents for federal tax purposes.

Dependents of U.S. military personnel

If you are the dependent of a member of the U.S. Armed forces, you can submit either:

- Original documents

- Certified copies of original documents, or

- Notarized copies of identification documents

You must also provide a copy of the servicemember’s U.S. military identification card, or you must be applying from an overseas APO/FPO address. If the documents are notarized, then you must submit a copy of the military ID.

An ITIN applicant selecting this category must enter their relationship in the space provided, as well as the name and SSN or ITIN of the U.S. citizen or resident alien, unless

- The applicant is a dependent of U.S. military personnel stationed overseas, or

- The applicant is from Canada or Mexico and an allowable tax benefit is involved

Box (e): Spouse of U.S. citizen/resident alien

Select this box if you are:

- A resident or nonresident alien spouse who isn’t filing a U.S. tax return, and you are not eligible for an SSN, but you can be claimed as an exemption, or

- A resident or nonresident alien spouse who is ineligible for an SSN, but you elect to file a joint tax return with a spouse who is a U.S. citizen or resident alien

If you select Box e, then you must enter the name and complete SSN or ITIN of the spouse who is a U.S. citizen or resident alien.

Box (f): Nonresident alien student, professor, or researcher filing a U.S. federal tax return or claiming an exception

This box is for an individual who hasn’t abandoned his or her residence in a foreign country and who is a bona fide student, professor, or researcher coming temporarily to the United States solely to:

- Attend classes at a recognized educational institution

- To teach, or

- To perform research

If you check this box, you must provide your passport with a valid U.S. visa and complete the following lines below:

If your foreign address is in Canada, Mexico, or Bemuda, you do not have to provide a U.S.

visa.

If you are present in the United States on a work-related visa, but you will not seek employment, you can attach a letter from the Designated School Official (DSO) or Responsible Officer (RO) instead of applying to the Social Security Administration (SSA) for a Social Security number. This letter must clearly state that:

- You will not be seeking employment while in the United States, and

- Your presence is solely related to your studies

Box (g): Dependent/spouse of a nonresident alien holding a U.S. visa

This box is for an individual who can be claimed as a dependent in any tax year, or is a spouse on a U.S. federal tax return for a year prior to 2018, who:

- Is unable or ineligible to receive a Social Security number, and

- Who has entered the United States with a nonresident holding a U.S. visa

Applicants who use this category must:

- Attach a copy of your visa to your completed Form W-7 as proof of identity and

- Include a date of entry into the United States on Line 6d

Box (h): Other

If the reason for your ITIN request isn’t described in boxes a through g, check this box. Describe in detail your reason for requesting an ITIN and attach supporting documents.

If you’re applying because a third-party requires your tax identification number to file information returns, then you may be able to claim one of the applicable exceptions, listed below.

Exceptions to the tax return requirement

Exception 1. Passive income: Third-party withholding or tax treaty benefits

This exception may apply if you’re the recipient of any of the following types of passive income:

- Partnership income

- Interest income

- Annuity income

- Rental income

- Other passive income subject to third-party withholding or covered by tax treaty benefits

Exception 2. Other income

This exception may apply if:

- You’re claiming the benefits of a U.S. income tax treaty with a foreign country and you receive any of the following.

a. Wages, salary, compensation, and honoraria payments;

b. Scholarships, fellowships, and grants; and/or

c. Gambling income; or - You’re receiving taxable scholarship, fellowship, or grant income, but not claiming the benefits of an income tax treaty.

The IRS instructions for Form W-7 contain additional information about each of these exceptions.

Exception 3. Mortgage interest: third-party reporting

This exception may apply if you have a home mortgage loan on real property you own in the United States that’s subject to third-party reporting of mortgage interest. This might include IRS Form 1098, Mortgage Interest Statement.

Exception 4. Dispositions by a foreign person of U.S. real property interest: third-party withholding

This exception may apply if you’re a party to a disposition of a U.S. real property interest by a foreign person, which is generally subject to withholding by the transferee or buyer (withholding

agent).

This exception may also apply if you have a notice of non-recognition under Treasury Regulations Section 1.1445-2(d)(2).

Exception 5. Treasury Decision (T.D.) 9363

This exception may apply if you have an IRS reporting requirement as a non-U.S. representative of a foreign corporation who needs to obtain an ITIN for the purpose of meeting their e-filing requirement under T.D. 9363 and you are submitting Form W-7.

Taxpayer information

In this section, we’ll enter taxpayer information, starting with taxpayer name.

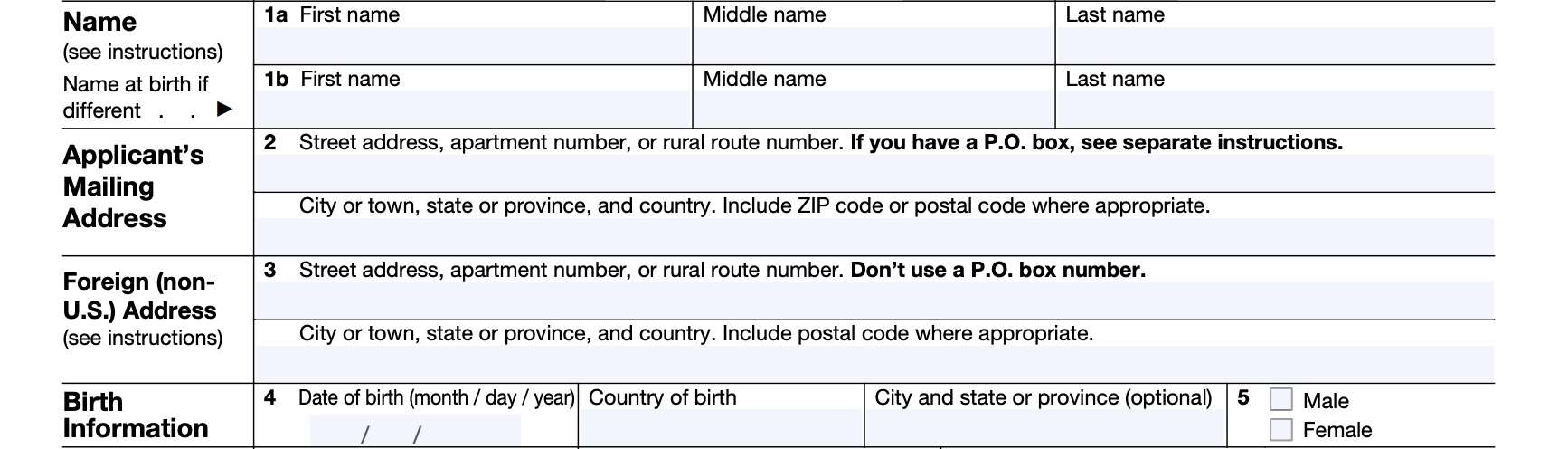

Line 1a: Legal name

In Line 1a, enter your legal name as it appears on your identification documents. If you’re renewing your ITIN, and your legal has changed since your original application, you’ll need to submit additional documentation supporting your name change.

This could include documents like your marriage certificate or a court order, such as a divorce decree.

Line 1b: Birth name

If different from Line 1a, enter your birth name, as it appears on your birth certificate.

Line 2: Mailing address

Enter your complete mailing address here. This is the address the IRS will use to return your original documents and send written notification of your ITIN application status.

Unless you include a U.S. federal tax return with your completed Form W07, the IRS won’t use this address you enter to update its records for other purposes.

If you changed your home mailing address since you filed your last tax return, and you are not including a tax return with your ITIN application, then you should also file IRS Form 8822, Change of IRS, at the address listed in the Form 8822 instructions.

If the U.S. postal service will not deliver mail to your physical location, then enter your P.O. Box number for your mailing address. Do not use a P.O. box owned or operated by a private company.

Line 3: Foreign address

Enter your complete foreign (non-U.S.) address in the country where you permanently or normally reside, even if it’s the same as the address on Line 2.

If you no longer have a permanent foreign residence due to your relocation to the United States, enter only the foreign country where you last resided here.

For people claiming a benefit under an income tax treaty with the United States, the income tax treaty country must be the same as the country listed here.

If you selected Box b as the reason for your application, then you must enter a complete address in this field.

Line 4: Birth information

Enter the following information as listed on your birth certificate:

- Birth date (use MM/DD/YYYY format, not DD/MM/YYYY)

- Country of birth

- City and province (optional)

Line 5

Check either Male or Female, as applicable.

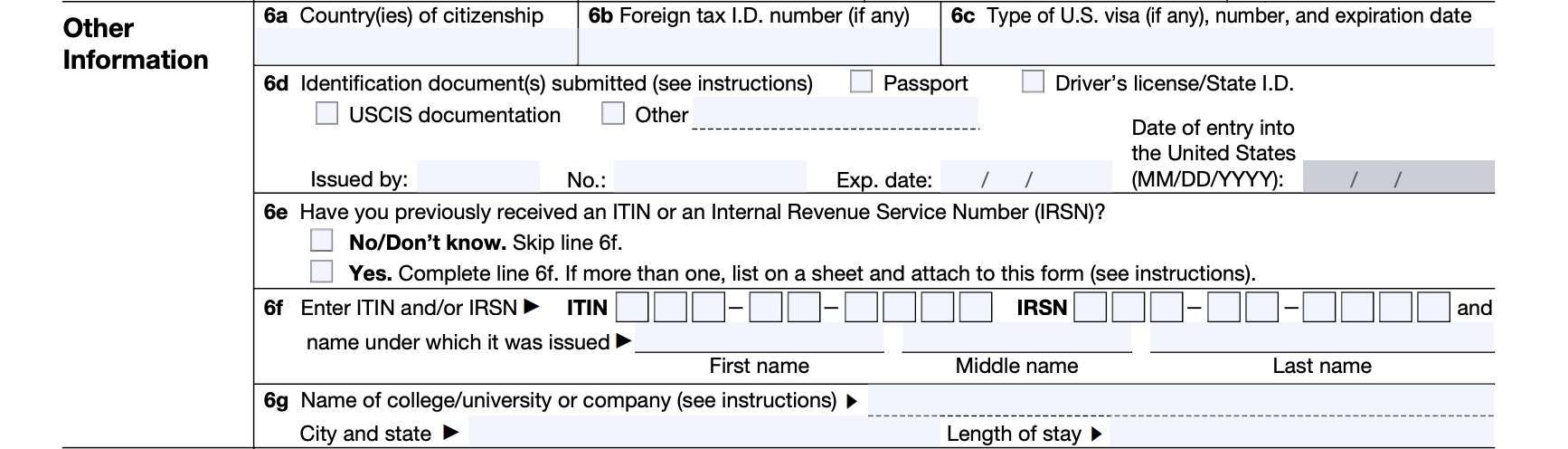

Other information

In this section, we’ll enter other information about your origin, existing documents, and ITIN numbers that may have been previously assigned.

Line 6a: Country of citizenship

Enter the complete name of the country where you are citizen. If you are a dual-citizen, enter all countries that apply.

Line 6b: Foreign tax I.D. number

If your country of residence for tax purposes has issued you a tax identification number, enter that number here.

Line 6c: Type of visa & expiration date

Enter only U.S. nonimmigrant visa information.

You should include:

- USCIS classification

- Number of the U.S. visa

- Expiration date (MM/DD/YYYY format)

Line 6d: Identification documents

Check the box indicating the type of document or documents you’re submitting as proof of identity.

Enter the following:

- Name of the state or country or other issuer

- Identification number appearing on the doucments

- Date you entered the United States (MM/DD/YYYY format)

If you’re submitting a passport or a certified copy of a passport from the issuing agency, then you do not need to submit additional documents. Ensure that your visa information correctly appears on Line 6c. Also include the pages of your passport that show your U.S. visa with your completed Form W-7.

The U.S. government will no longer accept a passport without a date of entry into the United States unless the dependent(s) are:

- From Canada or Mexico

- Dependents of U.S. military personnel stationed overseas

If you’re submitting multiple documents, only include information for the first document here. Attach a separate sheet indicating the required information for the additional documents. Write your name and ‘Form W-7’ at the top of the additional sheet.

Line 6e

Check the appropriate box. If you have never received an ITIN or an Internal Revenue Service Number (IRSN), then skip Line 6f and go to Line 6g.

Otherwise, go to Line 6f to enter your ITIN or IRSN.

Line 6f: ITIN number or IRSN number

If you previously received an ITIN or an IRS number, enter that number here. Also enter the name under which the number was issued.

Line 6g: University or company

If you checked Box f, you must enter the name of the educational institution and the city and state in which it’s located. You must also enter your length of stay in the United States.

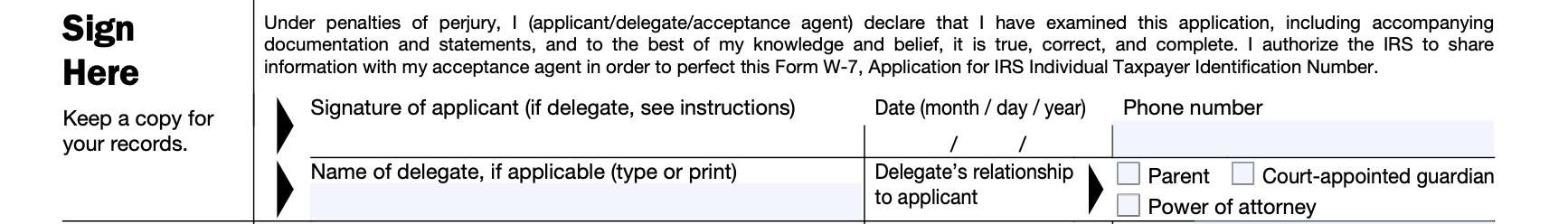

Signature

At the end of the form, you’ll sign, under penalties of perjury, that the application is complete and accurate to the best of your knowledge.

If you are working with an authorized acceptance agent, then this signature gives the IRS permission to share your information with that acceptance agent for purposes related to your Form W-7.

Also date the form (MM/DD/YYYY format) and enter your phone number. If you are applying as a delegate on someone’s behalf, then enter your name and relationship to the applicant as well.

Generally, the applicant must sign this form, but there are exceptions.

Applicant is a dependent under age 18

If the applicant is a dependent under 18 years of age, his or her parent or court-appointed guardian can sign if the child can’t sign.

Adults who are not a parent or court-appointed guardian can only sign if a parent or court-appointed guardian has granted permission by filing IRS Form 2848, Power of Attorney and Declaration of Representative.

Applicant is a dependent over age 18

If an applicant is 18 years of age or older, the applicant or a court-appointed guardian can sign or appoint a parent or another individual to sign.

Individuals other than the applicant or court-appointed guardian must also submit a completed Form 2848 that grants them authority to sign Form W-7.

Applicant cannot sign

If an applicant can’t sign his or her name, then the applicant must sign his or her mark (for example, an “X” or a thumbprint) in the presence of a witness.

The witness’s signature is also required and must be identified as that of a witness.

Who is eligible to file IRS Form W-7?

Any individual who isn’t eligible to get an SSN but who must furnish a taxpayer identification number for U.S. tax purposes or to file a U.S. federal tax return must apply for an

ITIN on Form W-7.

Also, individuals who need to renew an ITIN to file U.S. tax returns may file IRS Form W-7.

Examples include the following:

- A nonresident alien individual claiming reduced withholding under an applicable income tax treaty for which an ITIN is required

- A nonresident alien individual not eligible for an SSN who is required to file a U.S. federal tax return or who is filing a U.S. federal tax return only to claim a refund.

- A nonresident alien individual not eligible for an SSN who elects to file a joint U.S. federal tax return with a spouse who is a U.S. citizen or resident alien.

- A U.S. resident alien (based on the number of days present in the United States, known as the “substantial presence” test) who files a U.S. federal tax return but who isn’t eligible for an SSN.

- A nonresident alien student, professor, or researcher who is required to file a U.S. federal tax return but who isn’t eligible for an SSN, or who is claiming an exception to the tax return filing

requirement. - An alien spouse claimed as an exemption on a U.S. federal tax return who isn’t eligible to get an SSN.

- An alien individual eligible to be claimed as a dependent on a U.S. federal tax return but who isn’t eligible to get an SSN.

- A dependent/spouse of a nonresident alien U.S. visa holder who isn’t eligible for an SSN.

Should I file IRS Form W-7?

We should note a couple of things before you submit your ITIN application:

Don’t complete the Form W-7 application if you are eligible for a Social Security number

If you are eligible for a Social Security number, then you should submit an application for one. Instead of completing Form W-7, you would complete Form SS-5, Application for a Social Security card.

Your ITIN is for federal tax filing purposes only

Having an ITIN only allows you to file federal tax returns. It does not:

- Change your immigration status or right to work in the United States

- Entitle you to Social Security benefits

Having an ITIN may limit certain tax benefits

The IRS outlines restrictions on tax benefits, to include tax credits, which are not available to ITIN holders. These include, but are not limited to:

- Earned income credit, as claimed on Schedule EIC

- Children with an ITIN cannot be claimed as a qualifying child for EIC purposes

- Also cannot be claimed for the child tax credit or additional child tax credit on Schedule 8812

For other tax benefits, you may need to submit your completed Form W-7 with the appropriate tax return for which you are claiming the benefit.

- Head of household status: Attach a tax return listing the applicant as a dependent. Dependent applicants must be:

- Qualifying children or qualifying relatives, and either

- Have lived with you for over half the year, or

- Be your parent

- Dependent applicants must be qualifying children or relatives of the taxpayer claiming AOTC

Required supporting documents

Whether you are applying for a new ITIN or renewing an existing ITIN, you must provide documentation that meets certain federal government requirements.

You must submit documentation to establish your identity and your connection to a foreign country

Generally, applicants who are claimed as dependents must also prove U.S. residency. However, if you are from Canada or Mexico, or if you are a dependent of a U.S. servicemember stationed overseas, you are exempt from this additional requirement.

You must submit original documents or certified copies that support the information you provide

A certified copy of a document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the agency.

You may be able to request a certified copy of documents at an embassy or consulate.

Original documents you submit will be returned to you at the mailing address shown on your Form W-7. You don’t need to provide a return envelope, but you can include a prepaid Express Mail or courier envelope for faster return delivery of valuable documents such as passports.

If you do not receive your documents within 60 days, contact the IRS.

The documentation you provide must be current, not expired

There are 13 acceptable documents, as shown in the following table:

Only a passport may be submitted by itself. If submitting other forms of identity, you may be required to provide additional supporting documentation.

Proof of U.S. residency for applicants who are dependents

A passport that doesn’t have a date of entry into the United States won’t be accepted as a stand-alone identification document for dependents, unless they are from Canada or Mexico, or are dependents of U.S. military personnel stationed overseas.

In these cases, applicants will be required to submit at least one of the following original documents in addition to the passport to prove U.S. residency.

- If under 6 years of age:

- A U.S. medical record,

- U.S. school record, or

- U.S. state identification card that lists the applicant’s name and U.S. address, or

- a U.S. visa.

- A U.S. school record, or

- U.S. state identification card that lists the applicant’s name and U.S. address, or

- a U.S. visa.

- A U.S. school record

- Rental statement from a U.S. property

- Utility bill for a U.S. property

- U.S. bank statement

- U.S. state identification card or driver’s license that lists the applicant’s name and U.S. address, or

- a U.S. visa.

Video walkthrough

Find more instructional guidance on using Form W-7 to obtain an ITIN by watching this video!

Frequently asked questions

What is an IRSN?An IRSN is a nine-digit number issued by the IRS to people who file a tax return or pay taxes without providing a taxpayer identification number or Social Security number. The IRSN appears on any IRS correspondence related to that tax return.

What is an ITIN used for?The IRS assigns individual taxpayer identification numbers (ITINs) to help individuals to comply with U.S. tax laws, and to efficiently process tax returns and payments for taxpayers who are not eligible for Social Security numbers.

Where can I find IRS Form W-7?

As with other IRS forms, you can find Form IRS W-7 on the IRS website. For your convenience, we’ve attached the latest version to this article.

- Qualifying children or qualifying relatives, and either